Tuesday 29 October 2013

Property Observer: most read articles

Take a read here.

China data extends US stock records

The S&P 500 has now closed up for 9 consecutive trades as investors continue to be buoyed be stimulus.

Spillard (again) ends in Kevenge

Rudd's election campaign will doubtless be run along the lines of portraying Labor as the "proven" or known quantity which has steered Australia away from recession through a challenging period. Abbott will be portrayed as the "risky unknown quantity" (not without some reason, it must be said).

Well, yep, I guess it will - in two or three months when the whole debacle will finally be ended by an election and a leadership contest which we're actually allowed to vote in.

Too easy a win for Queensland in Origin II at Suncorp stadium - sends the Aussie dollar back up to 92.9 cents...

Monday 28 October 2013

Market psychology (Sydney property booming)

RP Data shows that prices in Adelaide have waned badly in the last quarter are now lower than they were 12 months ago, despite generational lows in interest rates. Prices have also fallen slightly year-on-year in Hobart. Brisbane has fared no better than Adelaide over the past half-decade with median prices below levels seen in 2008, and many regional markets have been in a steady decline for several years now.

The Biggest Estate on Earth: How Aborigines Made Australia

List Price: $45.00

Special Offer: check this out!

Related Products

- The Fatal Shore: The Epic of Australia's Founding

- Aboriginal Australians: A History Since 1788

- Special Tasks

- The Original Australians: Story of the Aboriginal People

Product Description

Reveals the complex, country-wide systems of land management used by Aboriginal people in presettlement Australia Across Australia, early Europeans commented again and again that the land looked like a park, with extensive grassy patches and pathways, open woodlands, and abundant wildlife. Bill Gammage has discovered this was because Aboriginal people managed the land in a far more systematic and scientific fashion than most peoplehave ever realized. For more than a decade, he has examined written and visual records of the Australian landscape. He has uncovered an extraordinarily complex system of land management using fire, the life cycles of native plants, and the natural flow of water to ensure plentiful wildlife and plant foods throughout the year. Aboriginal people spent far less time and effort than Europeans in securing food and shelter, and this book reveals how. Once Aboriginal people were no longer able to tend their country, it became overgrown and vulnerable to the hugely damaging bushfiresAustralians now experience. With details of land-management strategies from around Australia,this bookrewrites the history of the continent, with huge implications for today.

Buy The Biggest Estate On Earth: How Aborigines Made Australia ... Buy The Biggest Estate On Earth: How Aborigines Made Australia (Australasian & Pacific History Book) by Bill Gammage (9781743311325) - Explodes the myth that pre ... Review of 'The Biggest Estate on Earth' by Bill Gammage Timothy ... Review of Bill Gammage's 'The Biggest Estate on Earth' in which I address problems with the book's address, method and politics. Australias Aborigines Launch a Bold Legal Push for Independence ... If a determined group of indigenous people get their way, the worlds newest country wont be in Africa or the Balkans but on the eastern periphery of ... Australian aborigines: Information from Answers.com Australian Aborigine Any of the indigenous peoples of Australia. The first Australians are estimated to have reached the continent at least 50,000 years Aboriginal Culture - Introduction to Australia's Aboriginal Culture Introduction to Australia's Aboriginal Culture by David M. Welch. This page talks about ancient stone tool technology, Aboriginal rock art, Aborignines from Tasmania ... Buy The Biggest Estate On Earth: How Aborigines Made Australia ... Buy The Biggest Estate On Earth: How Aborigines Made Australia (Book) by Bill Gammage (9781743311325) - Explodes the myth that pre-settlement Australia was an untamed ... The biggest estate on earth: how Aborigines made Australia 8 December 2011, 6.34am AEST The biggest estate on earth: how Aborigines made Australia Indigenous Australians - Wikipedia, the free encyclopedia Indigenous Australians are the original inhabitants of the Australian continent and nearby islands. Indigenous Australians migrated from Africa to Asia around 70,000 ... Booktopia - The Biggest Estate on Earth, How Aborigines made ... Booktopia has The Biggest Estate on Earth, How Aborigines made Australia by Bill Gammage. Buy a discounted Hardcover of The Biggest Estate on Earth online from ... The Biggest Estate on Earth - Allen & Unwin - Home Explodes the myth that pre-settlement Australia was an untamed wilderness revealing the complex, country-wide systems of land management used by Aboriginal people.

Sunday 27 October 2013

RBA's chart pack shows uneven property market recovery

---

Aussie dollar is crumbling...it touched 94.4 cents earlier in the trade. Stay tuned for US payrolls tomorrow...

The accelerating Australian population boom

On the other hand, take a look at what is happening in the states which house the major capital cities.

The population of WA is absolutely booming by 3.5% in the year to December 2012 or 83,000 people, so it's little wonder that the Perth property market is flying.

And in Queensland (+92,500), Victoria (+99,500) and New South Wales (+90,400) the population growth continues apace.

It's small wonder that we struggle to keep up with accommodation and infrastructure needs with population growth figures such as these reported today.

Hohner 560BX-C Special 20 Harmonica, Major C

Features

- Played by the Pros

- Smooth Plastic Body for fast Playing

- Responsive Reeds

- German Quality and Craftsmanship

List Price: $58.00

Special Offer: check this out!

Related Products

- Hohner Zippered Harmonica Soft Case

- Harmonica For Dummies

- Hurricane Harps THS_Harmonica_Pouch The Harmonica Store - Pouch for 10 Hole Diatonic Harmonicas

- Hohner Harmonica Holder HH01

- Hohner Special 20 Harmonica, Key of G

Product Description

Special 20 - Awesome response, superior bendability and the sweetest tone ever. This harp is the first choice for those learning to play. Its special airtight design makes it the most recommended go-to harp for harmonica players of any style, including blues, country, folk or rock. The plastic comb doesn't absorb moisture making it longer lasting. Harp of choice of harmonica virtuoso John Popper (of Blues Traveler) and played by Bob Dylan on his 2007/08 tour. Chances are your favorite player has several of these harps in his case. 12 major keys plus lower and higher octave tunings. It is approximately 4 inches long.

Hohner Special 20 Harmonica H560 All Major Keys from Harmonica.com Hohner Special 20 Harmonica H560 All Major Keys (Key of C Recommended for Beginners) List Price: $58.00 Your Sale Price: $46.40 You Save: $11.60. Select Your Keys at ... Harmonicas eBay Visit eBay for great deals in Harmonicas. Shop eBay! The Tombo Ultimo Harmonica - Todd Parrott - YouTube Tombo manufactures the Lee Oskar harmonica line for the USA market. Here's a demo of the Tombo Ultimo. Lee Oskar Major Diatonic Harmonica - YouTube The Major Diatonic harmonica is the most commonly used tuning for playing Blues, Rock, Country Folk & Jazz. Major Diatonic harps are produced by several ... hohner harmonica in Harmonica eBay - Electronics, Cars, Fashion ... Find hohner harmonica and hohner marine band harmonica from a vast selection of Harmonica. Get great deals on eBay! Harmonicas from Hohner at zZounds.com Get free shipping & low prices at zZounds.com. Come see why zZounds service is rated so high & join 600,000+ happy customers. Hohner at zZounds - zZounds.com - Musical Instruments Music Store ... Hohner has been producing quality harmonics for over 150 years. Today, Hohner offers harmonics, melodicas and more to meet the needs of any player and style. Online UK Harmonica for beginners and pro's. Blues harp ... Blues harp gear at Honkin' Harmonica Shop. Beginners harmonica set, vintage mic, amplifiers, microphones and Hohner harmonicas for sale. Amazon.com: Hohner 560BX-C Special 20 Harmonica, Major C: Musical ... Special 20 - Awesome response, superior bendability and the sweetest tone ever. This harp is the first choice for those learning to play. Its special airtight design ... CONSEILS GENERAUX SUR LES HARMONICAS DIATONIQUES CONSEILS GENERAUX SUR LES HARMONICAS DIATONIQUES HYGIENE Pour jouer de votre instrument, il vous faut respecter une bonne hygine buccale.

UK growth confirmed at 0.6% in Q2

Saturday 26 October 2013

AUD touches 91.58 cents

Owner occupied housing finance +1.8% in May

The number of owner occupied commitments also continues to surge upwards (+2.6%) in May to 49,636, and is up for the 7th month in a row. The trend is up very strongly over the last couple of years.

Source: ABS

Source: ABS

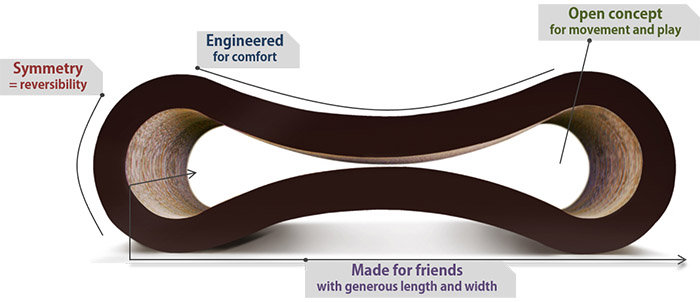

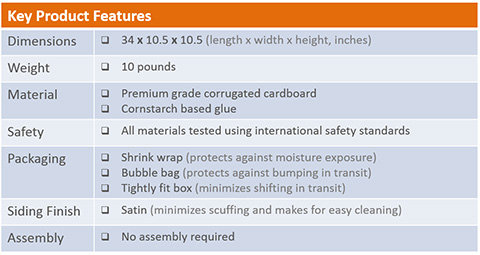

PetFusion Cat Scratcher Lounge, Walnut Brown

Features

- See video on left for additional details.

- Both a scratcher and a lounge, reversible for twice the use; Sleek and neutral design made of eco-friendly, recycled corrugated cardboard

- Naturally attracts cats; Curves make for easier scratching and a more comfortable place to rest and play

- Large surface area to hold multiple or larger cats and provide generous scratching space

- Durable construction and dense cardboard lasts longer than other scratchers

- Featured on Animal Planet's 'My Cat From Hell'; Recommended to save your furniture

List Price: $99.99

Special Offer: check this out!

Related Products

- Cat Dancer 301 Cat Charmer Interactive Cat Toy

- SmartCat Ultimate Scratching Post

- SmartyKat CatnipMist Catnip Infused Spray, 7-Ounce

- From The Field FFC301 1-Ounce Catnip Spray Rejuvenator

- Duranimals DuraScoop Cat Litter Scoop (colors may vary)

Amazon.com

Engineered for your cats health and happiness. Designed for your home.

Exceptional value In your home

Save your furniture. Made just for your feline loved one(s) to scratch, rest, and play on. ![]()

Lounging ![]()

Scratching ![]()

Perching

Long lasting. Lasts as much as 10 times longer than cheaper alternatives. ![]()

Exploring ![]()

Meet up ![]()

Modern art

Healthier, happier cat. Promote healthy nails, muscles, and communication.

cat scratcher lounge eBay - Electronics, Cars, Fashion ... Find great deals on eBay for cat scratcher lounge and cat lounge. Shop with confidence. Scratchers - Free shipping at Chewy.com - Dog and Cat Food, Treats ... FREE shipping on orders $49+ and the BEST customer service! Shop for all SCRATCHERS at Chewy.com. New Cat Condos Sisal Rope Scratching Post items in Wayfair store ... 673 results found: New Cat Condos Sisal Rope Scratching Post The Refined Feline 69" The Lotus Cat Tree in Espresso Kitty City 46" Mega Kit Cat Perch Go Pet ... pet lounge eBay - Electronics, Cars, Fashion, Collectibles ... Newly listed Littlest Pet Shop Fairy Tiara Princess Kitten Cat Set w/ Lounge Exclusive *RARE* PetFusion Cat Scratcher Lounge - Deluxe (Charcoal Gray): Amazon.ca ... Tired of purchasing cat products that your feline loved ones get bored of, quickly? PetFusion's Cat Scratcher Lounge serves double duty as both a cat scratcher and ... Products Pet Fusion At PetFusion, our ultimate goal is to fuse your world with your pets. Most pet product companies are focused solely on the solution for the pet need, but we see the ... For Cats Pet Fusion Dimensions: 16 x 8.6 x 4 inches Weight: 2.25 pounds. Original Price: $59.95 Sale Price: $34.95 . Elevated design aids in healthier digestion of food ... Amazon.com: PetFusion Cat Scratcher Lounge, Walnut Brown: Pet Supplies See video on left for additional details. Both a scratcher and a lounge, reversible for twice the use; Sleek and neutral design made of eco-friendly, recycled ... Amazon.com: Infinity Cat Scratcher Lounge: Pet Supplies Infinity Cat Scratcher Lounge provides a place for your feline friends to scratch, nap, and play. The multiple scratching surfaces will keep your cat satisfied and ... Round Cardboard Cat Scratcher Refills Home and Garden - Shopping.com PetFusion Walnut Brown Cat Scratcher Lounge, Scratcher Lounge; Cat scratcher and lounger in one! Specially made for cats who enjoy scratching, playing, and lounging ...

Retail sales on the road to nowhere...

Source: ABS

Friday 25 October 2013

Not so super...

Source: ASX

Foot & Heel Balm Cream Plus for very dry, rough feet & cracked heels , NO PARABENS, NO CHEMICALS, NON-STEROIDAL - Visible Effects Within 5 Days! Made in Australia! BEST QUALITY!

Features

- A clinically proven and dermatologically tested heel balm with a triple action formula to eradicate the most stubborn cases of dry, rough, cracked and hard thickened skin. It is fast acting providing visible effects within 5 days.

- Unlike other heel balms, DU'IT Foot & Heel Balm Plus is non-greasy, easily absorbed, and free from lanolin, parabens, petroleum chemicals and artificial fragrances making it suitable for even the most sensitive skin types.

- DIABETIC FOOT CARE - particularly recommended for diabetic foot care due to its natural exfoliation, softening and the unique moisturizing 3-in-1 properties.

List Price:

Special Offer: check this out!

Product Description

Visible effects within 5 daysSoftens hard skinEliminates callusesHeals cracked heelsExfoliates dead skinNon-greasy barrier protectionDiabetic foot careNo added fragranceClinically provenDermatologist testedFree from Parabens, Petrolatum, Mineral Oil, Lanolin and Propylene GlycolA clinically proven and dermatologically tested heel balm with a triple action formula to eradicate the most stubborn cases of dry, rough, cracked and hard thickened skin. It is fast acting providing visible effects within 5 days. Unlike other heel balms, DU'IT Foot & Heel Balm Plus is non-greasy, easily absorbed, and free from lanolin, parabens, petroleum chemicals and artificial fragrances making it suitable for even the most sensitive skin types.

Google Pubsubhubbub Hub Welcome to the Google PubSubHubbub Hub! This hub conforms to the Pubsubhubbub 0.4 specification. In addition, this hub conforms to the Pubsubhubbub 0.3 specification ... dirurl - Free Backlink Builder Get Automatically 113 backlinks to your site from dirurl - The best Free Backlink Builder Vaginal Itching Without Discharge or Odor Women's Health Forum: I've been experiencing a vaginal itch for a while now and I was hoping someone can shed some light on what my problem is. I surfed around The Q&A wiki WikiAnswers: Questions and Answers from the Community ... What are the differences between structures and unions in C plus plus? A structure is simply a class, but ... Roz designz christian web design company Think PINK! Contact roz for an affordable website package customized especially for you. What's New? Ecommerce-get your store online today! XGames Download jocuri torrent 2013 - Home page < img src="http://www.xgames.ucoz.org/Baner_Xgames.gif" alt="Download XGames torent full free gratis" /> Acceptable Words to Query by on Twitter Plotter A List of Currently Acceptable Words to Query By: the. i. for. been. brown. fragrance. wind: peppermint. reed. badd. immune. pai. senators. classified. as needed. ...

SQM's take on falling prices...

This seems to make more sense to me than prices sprinting ahead in Q1 and then falling. If anything gains were likely weak in Q1 and are now picking up.

US jobless claims drop to 5.5 year low

Thursday 24 October 2013

RBA retains easing bias; stocks rocket 2.63%

Wednesday 23 October 2013

Could one of Australia's main lenders fail? (and what would happen if they did?)

Tuesday 22 October 2013

Mad Catz V.7 Keyboard for PC

Features

- Multi-color Backlighting - Tru-Vu illuminations allow you to set the mood and illuminate your world, mixing shades from Red through Amber to Green.

- Touch-sensitive, backlit dashboard Control Panel - Configure your lighting, media and volume controls with the brush of a finger.

- WASD, cursor, 'Mad Catz' and NumPad keys can be lit independently from the rest of the keyboard to highlight commonly used gaming keys - Set each area to your preferred color or brightness to make the keyboard battle ready.

- Mad Catz Mode - Instantly disable the Windows keys and change the color and brightness of your gaming keys at the touch of a button.

- Pass-through USB, audio and microphone sockets means no more crawling behind your PC to change your USB device or audio configuration. Gold-plated connectors for USB and audio.

- 12 programmable 'Mad Catz' keys - Store your favorite macros for buying equipment, activating abilities or just for initiating your favorite trash talk. Enhanced multiple key presses in gaming areas for complex in-game commands.

- Adjustable gaming keyboard

- Fully programmable with included SST software

- Hard wearing, metal-plated key caps in key gaming areas are designed to withstand the punishment that pro gamers demand.

- Media keys and hard wearing surfaces

- Powerful ST Programming Software - Create profiles for each game that you play in order to save different button configurations.

- Tri-Color Backlighting

- True-Vue Key Illumination

List Price: $79.99

Special Offer: check this out!

Related Products

- Mad Catz R.A.T.5 Gaming Mouse for PC and Mac

- Mad Catz R.A.T.5 Gaming Mouse for PC and Mac

- Mad Catz R.A.T.7 Gaming Mouse for PC and Mac

- Perixx MX-1000 Copper, Programmable Gaming Mouse - 7 Programmable Button & 5 User Profile - Omron Micro Switches - Gold-plated USB Connector - Braided Fiber Cable - Avago 2000DPI A3050 Optical Sensor - DPI Switch 500-4000 - Ultra Polling 1000HZ

- Mad Catz M.M.O.7 Gaming Mouse for PC and Mac

Product Description

The Saitek PK17U standard Mad Catz keyboard inherits the great features of its predecessors while bringing even more incredible features, including ergonomically placed Windows and Internet shortcut keys, height adjustment and a removable wrist rest.

Amazon.com: Mad Catz S.T.R.I.K.E.7 Gaming Keyboard: Computers ... Mad Catz S.T.R.I.K.E. 5 Gaming Keyboard for PC Create Your Perfect Gaming Interface When a fraction of a second is all that divides victory from defeat, you must ... Mad Catz All About the Game Provides controllers and peripherals for Playstation, Dreamcast, PC, and Nintendo. Cyborg V.7 Keyboard - Achat / Vente CLAVIER Cyborg V.7 Keyboard ... Vite ! Dcouvrez l'offre Cyborg V.7 Keyboard pas cher sur Cdiscount. Livraison rapide et Economies garanties en CLAVIER ! MAD CATZ S.T.R.I.K.E. 7 Keyboard for the PC Create Your Perfect Gaming Interface. When a fraction of a second is all that divides victory from defeat, you must be in absolute harmony with your gaming setup. .com - Mad Catz S.T.R.I.K.E. 7 Gaming Keyboard for PC ... S.T.R.I.K.E. 7 Gaming Keyboard for PC. Saitek Cyborg V.7 Keyboard Un-boxing - YouTube The Cyborg V.7 Keyboard from Saitek (Mad Catz). While not exactly new (by today's standards), this keyboard is still a very good option for any PC gamer ... Mad Catz S.T.R.I.K.E. 7 Gaming Keyboard for PC When a fraction of a second is all that divides victory from defeat, you must be in absolute harmony with your gaming setup. Every command and key location must be ... Mad Catz Rock Band 3 Wireless Keyboard - YouTube Mad Catz Global PR Manager Alex Verrey showcases the new wireless keyboard / "keytar" for Rock Band 3. To view our full line of Rock Band 3 accessories ... Mad Catz S.T.R.I.K.E. 5 Gaming Keyboard for PC - GameShark Store GameShark Store is a distributer of Mad Catz controllers and other peripherals for the Microsoft Xbox 360, Sony Playstation 3, Nintendo Wii consoles and PC game ... Amazon.com : Mad Catz V.7 Keyboard for PC : Gaming Keyboard ... System Requirements: Connectivity: USB 2.0 Windows 7 Windows Vista Windows XP Supports all 32-bit and 64-bit versions. Mad Catz V.7 Gaming Keyboard for PC Unique ...

Monday 21 October 2013

Arkon 18.5-Inch Flexible Gooseneck Seat Bolt Floor Mount for iPhone 4 with Slim-Grip Phone Holder - Bulk Packaging - Black

Features

- Designed to fit ALL iPhones regardless of whether a protective case or silicone sleeve is attached to the phone

- Easy to install

- Provides full 360 Swivel feature and flexible extension arm

- Compatible with all models including iPhone 4, 3GS, 3G, Original and iPod Touch

- Compact, Slim Design fits phones having heights between 80mm and 120mm tall

List Price: $29.95

Special Offer: check this out!

Related Products

- Extra Long Black iPod / iPhone 3G, 3GS, iPhone 4 USB Charge and Sync Cable, More Than Double the Length of the Standard Cord - 2m (6.5ft) Long. UPDATE: NOW FITS IPHONE 4 BUMPER AND ALL OTHER CASES

- Arkon Holder for Universal Mobile Phone, Smartphone and PDA - Black

- Arkon TAB-FSM Tablet Seat Bolt Mount

- Arkon Universal Mini Grip 15-Inch Floor Mount for Mobile Phones and Smartphone-Black

- Arkon IPM511 Sun Visor Car Mount for iPhone 4 / 4S with Slim-Grip Phone Holder

Product Description

Arkon's IPM525-S mount attaches to your car's passenger-side seat bolt location. Nearly all car's have an exposed or easily accessible passenger-side seat bolt. Arkon's IPM525-S utilizes this location to position your iPhone in the car within close proximity while providing a custom install look. Arkon's NEW Slim-Grip holder is ideal for use with ALL versions of the iPhone including the new iPhone 4, regardless of whether a protective skin or sleeve is used on the phone. Slim-Grip is the stylish, affordable, highly functional, quality iPhone holder that you've been waiting for. It features laterally adjustable support legs and a strong spring-loaded mechanism which securely grips your phone.

Amazon.com: Arkon 18.5-Inch Flexible Gooseneck Seat Bolt Floor ... Arkon's IPM525-S mount attaches to your car's passenger-side seat bolt location. Nearly all car's have an exposed or easily accessible passenger-side seat bolt. Arkon ... Amazon.com: Arkon TAB-FSM Tablet Seat Bolt Mount: Computers ... New innovative, adjustable tablet holder fits any tablet 7 to 12-Inch with or without a case or skin; 18.5-Inch flexible aluminum seat bolt floor mount with optional ...

UK house prices up to highest in 3 years

Bloomie:

Sunday 20 October 2013

The nature of growth

Not having children of my own, I forget just how darned noisy and energetic kids can be, and I'm also amazed at how they seemingly eat round the clock: breakfast at 7am, sausage sandwiches by 9am, morning snacks by 10.30..."Well, they're growing kids, y'know..." - and it's true enough, they definitely are growing!

And besides, why on earth should each successive generation pay more for property than its immediate predecessor? Particularly now that the deregulation of lending standards and products is well in the past and interest rates have fallen to as close to the 'zero bound' as they hopefully ever will be in Australia.

If you want to grow your own share portfolio, re-invest your dividends via a dividend re-investment plan (DRP).

Imputed rents don't make for a great measure of 'fair value' in residential property for they take little account of the emotional factors impacting homebuyers. In property, price is perhaps a far more appropriate word to use than value.

A property in strong demand might potentially move rather in tandem with the growth in household incomes over time, with the effective speed limit for price growth being the ability of the populace to service mortgage repayments.

So how does an investor source price growth which outperforms inflation over the long term? Ultimately, unless you are a skilled renovator (and, let's face it, most property investors definitely aren't) there's only one way that it is possible to do this, by finding a property which:

Investors tend to prefer capital cities and the combination of land-locked suburbs and growing populations tend to be a happy one for investors and an unhappy one for homebuyers, pushing the price of the prime-location land ever higher.

SQM's asking prices show multi-speed property recovery

RBA to hold rates tomorrow

Some thoughts on investment strategy

Warren Buffett once said that being out of the market introduces a different risk to being in the market, and over the history of stock markets, it has indeed been a costly one. Here's the Dow 5 year chart, courtesy of Bloomie:

Property trusts (once known as LPTs, now as A-REITS) have paid out high dividend ratios but demonstrated weak capital growth, sometimes diluting values through capital raisings for new projects.

Resources stocks have had a poor run since the onset of the global financial crisis. The 5 year chart of Rio Tinto (RIO) is an example of this under-performance, until its recent upturn which was buoyed by a bounce in the iron ore spot price.

Source: ASX

Generic advice

There is a worrying trend towards generic advice being issued from a wide range of sources on the internet. Each person has different financial goals, needs and risk tolerance levels, so generic advice is often misleading and could result in capital loss.

Even more worryingly, an awful lot of generic advice is dished out about investing (or very often not investing for whatever reason) by people who have never built an investment portfolio of their own.

Free advice is usually worth what you pay for it, as the old saying goes.

Ben Graham once said that if you have an amount available to invest regularly, then the only sensible investment strategy is to write yourself a contract committing to buying shares in good times and in bad on a regular basis.

This strategy is even more straightforward today because instead of having to buy a cross-section of the index to diversify your specific investment risk, you can simply invest regularly in a diversified product (such as an ETF or, my preferred option, an Australian LIC with heavy exposure to industrial stocks) which mirrors the balance of investments and risk profile you require.

My wife's index fund has just entered its 17th year of existence; that's nearly 200 consecutive months of share market acquisitions. This investment approach offers great peace of mind and requires very little skill other than discipline - you don't need to fret about how the market is performing on a day-to-day basis (if you are doing so, this maybe an indication that you have adopted the wrong investment strategy).

If the market falls, your money will just buy more stocks. And if it rises, your net worth increases and you buy fewer shares while the market is high. In the meantime, you can enjoy the growing dividend streams.

The only calibrating this investment approach might need is to learn to buy more heavily when the market suffers a major correction, such as it did through the financial crisis.

Most developed world economies are not like Japan and do not fall into a long spiral of deflation. Indeed, even in Japan, lessons have now been learned and stimulatory monetary policy has seen stock valuations surge by an astonishing 74% in the past year.

Property

Investment strategy in Australian property is a different beast for most average investors.

Statistics show that most Aussies do not ever invest in more than a handful of properties and therefore are unlikely to benefit from the averaging approach which so benefits share market investors.

The leverage involved can also mean that even when only buying a small number of property investments, the balance of a portfolio can be skewed towards this asset class, increasing the portfolio's risk.

Further, yields are so low on residential investment property that the asset class only becomes worthwhile for most if the investor can source reasonable capital growth. Cash flows can be reasonable on some commercial property types, but mostly this is not the case on residential stock.

For these twin reasons, it is important to invest only in areas where the population is forecast to increase for decades to come and there is little land available for release.

Commentators will continue to give the impression that they can forecast short-term market movements, despite the not-so-secret truth that they can't.

When you are granted a mortgage, the lender tends to give you a handy hint as to the appropriate time horizon for limiting risk in property investment in the terms of the loan: banks are comfortable that real estate is of an acceptable risk over 25 years.

Historically, this has been true, but investors would be wise to exercise care when selecting property investments and stick to those which suit their own risk profile.

---

CPI (inflation data) today, which will determine whether interest rates are cut again in August.